Request To Waive Penalty - Special Covid 19 Late Penalty Cancellation Request Forms Now Available News Desertnews Com / To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position.

Request To Waive Penalty - Special Covid 19 Late Penalty Cancellation Request Forms Now Available News Desertnews Com / To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position.. If you have an irs penalty on your hands, you can get a waiver. We will review your request and respond in writing. The office of the treasurer & tax collector will review your waiver request in accordance with the the san francisco business and tax regulations code (and/or the california revenue & taxation code where applicable) which allow the office to waive or cancel penalties, costs, fees or interest in certain, limited cases. I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year. The only way to get tax penalties waived is to request relief.

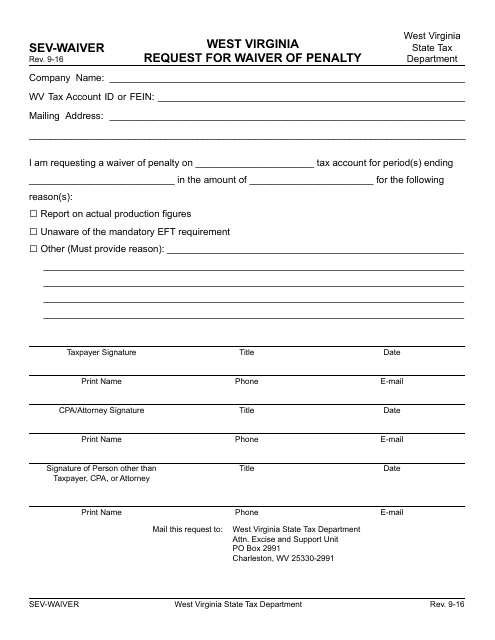

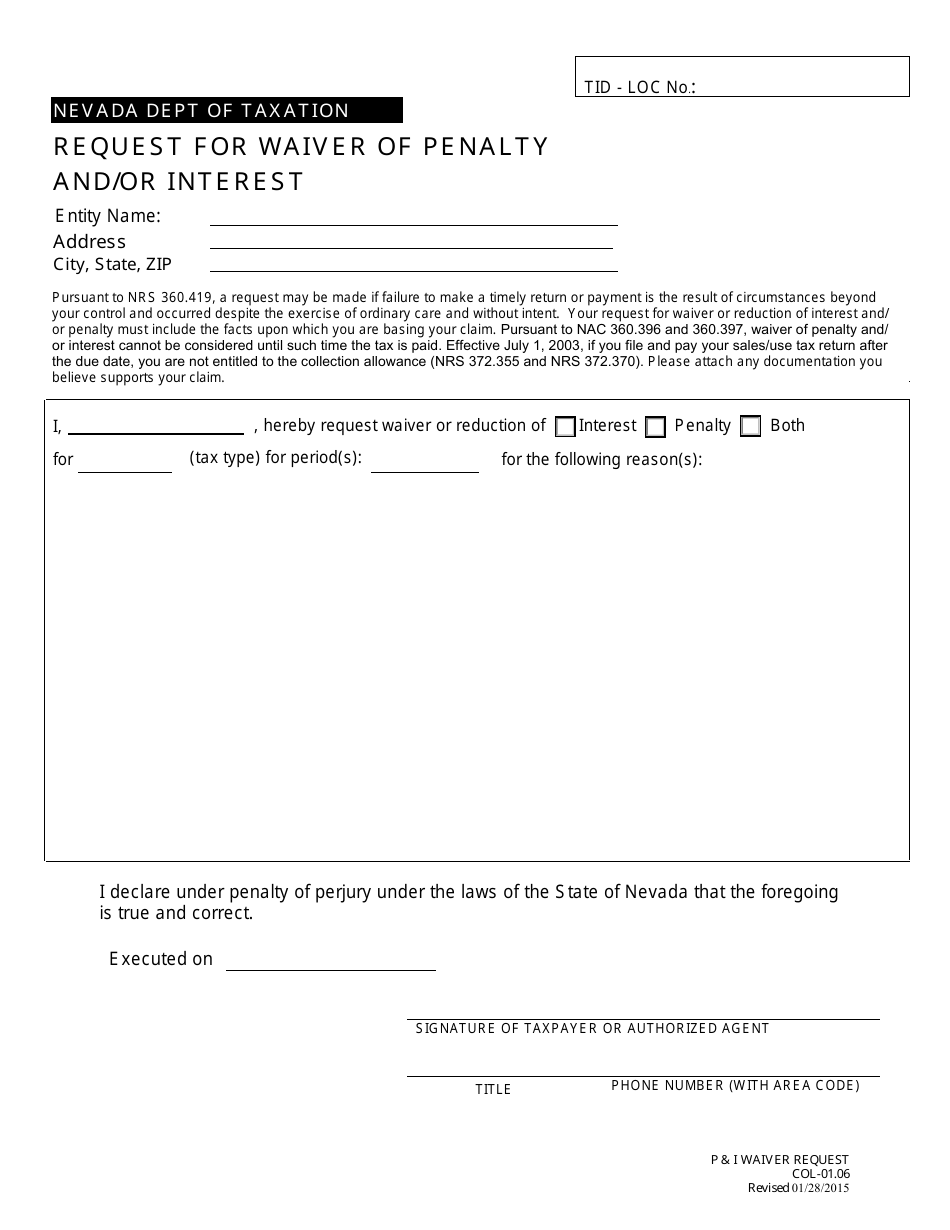

You can use our online form to request a waiver of penalties and/or interest that was assessed because you filed or paid a tax report late. Name of sender address of sender city, state, zip code. If you have an irs penalty on your hands, you can get a waiver. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. How to request a penalty waiver.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control.

Sample penalty abatement letter to irs to waive tax penalties. To obtain relief from penalty, interest, or the collection cost recovery fee, you must file a written request with the california department of tax and fee administration (cdtfa), signed under penalty of perjury. Essentially, if you miss a payment, don't file a tax return, or make a deposit, then you have a chance to avoid the penalty. Waiver of penalty request taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. James ray, who is an employee in your sales department, suggested i contact. This letter is a formal request to have my monthly payments of $150 on my car loan frozen for six months from date to date. While you are still responsible for any delinquent. Dear sir or madam, regarding checking account: You'll need the information to add your client to your account. If the waiver is denied, the penalties will be billed at a future date. We realize there were many changes that affected people last year, and this penalty waiver will help taxpayers who inadvertently didn't have enough tax withheld. If you file electronically, there is a box to check to request a penalty waiver. Please attach documentation to support your request if it is available.

We will review your request and respond in writing. You also are getting a waiver on the penalty itself rather than the taxes you owe. Bank or loan account number. The usual threshold to trigger a penalty is 90%. To do this, you must claim reasonable cause through an irs penalty abatement reasonable cause letter.

I would like to request that you consider reimbursing bank charges you applied to an unplanned overdraft that has been building up since last year.

For instance, you may be given a citation, a penalty fee, or a new financial obligation. Sample request letter dear mr./ms. The irs just dropped it to 80%. Bank or loan account number. Request for an interview my name is your name here and i am writing to request an interview to discuss available positions in the name of department with your company. The usual threshold to trigger a penalty is 90%. Taxpayers can request abatement of penalties within the normal refund statute of limitations which is 3 years from the date the return was filed or 2 years after the penalty was paid. The fact that i went in to the red at all is a testament to my financial hardship. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. We realize there were many changes that affected people last year, and this penalty waiver will help taxpayers who inadvertently didn't have enough tax withheld. If the waiver is denied, the penalties will be billed at a future date. The irs will not offer them to you, even if you qualify. Sample penalty abatement letter to irs to waive tax penalties.

If the irs has assessed penalties against you for failing to pay your federal taxes in full, paying them late, or failing to report your income, you do have the option of requesting that the irs abate or forgive these penalties. Reasonable cause shall include, but not be limited to, those instances in which the taxpayer has acted in good faith. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control. If you file electronically, there is a box to check to request a penalty waiver. How to request a penalty waiver.

Name of sender address of sender city, state, zip code.

Dear sir or madam, regarding checking account: Essentially, if you miss a payment, don't file a tax return, or make a deposit, then you have a chance to avoid the penalty. The irs just dropped it to 80%. The irs charges a tax penalty if you don't withhold enough of your taxes throughout the year. James ray, who is an employee in your sales department, suggested i contact. The irs will not offer them to you, even if you qualify. The taxpayer has the burden of proving that the penalty waiver request is valid. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. Waiver requests for late reports and payments the comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. While you are still responsible for any delinquent. If you haven't already added your client to your account, do so now. Sample irs penalty abatement request letter. For instance, you may be given a citation, a penalty fee, or a new financial obligation.

Komentar

Posting Komentar